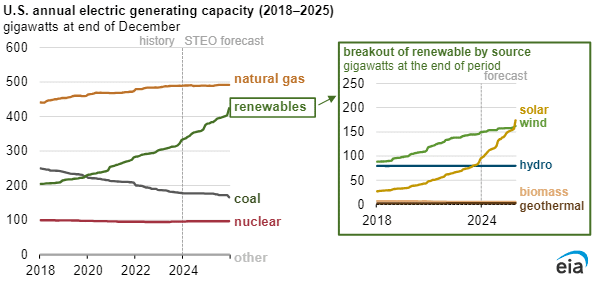

The U.S. Energy Information Administration (EIA) projects that solar power generation will increase by 75%, from 163 billion kWh in 2023 to 286 billion kWh by 2025.

How to sell solar systems comes down to, you guessed it right – an effective sales strategy that doesn’t just outline what you sell and how you sell but the marketing aspect of your operations. For those just starting to sell solar panels through direct sales and marketing methods, I’ve outlined everything they need to know to boost their results by connecting with customers, closing more deals, and establishing themselves in this fast-growing industry.

How to Sell Solar Products

1. Understand Your Market

Knowing your target audience isn’t just critical—it’s your foundation for success. Think about this: How can you sell solar products if you don’t understand who truly needs them? Let’s break it down:

- Homeowners: These are your bread-and-butter clients. Target those in sunny areas or regions with soaring electricity costs. Imagine the appeal of saving thousands over the years while contributing to a greener planet.

- Businesses: Small and medium enterprises often face tight budgets. Solar solutions can significantly slash operational costs while enhancing the brand’s eco-friendly image.

- Public Institutions: Schools and municipal buildings often have sustainability goals. Position solar energy as a way to meet these goals affordably and efficiently.

2. Build Product Knowledge

To win a customer’s trust, you need to speak their language. Mastering the technical details makes you a credible expert in their eyes. Here’s what you should focus on:

- Panel Specs: Know the differences between monocrystalline and polycrystalline panels. Customers often ask, “Which one’s better for me?”

- Installation Know-How: Outline the timeline and process with clarity. Explaining this upfront reduces hesitation.

- Rebates and Financing: Help them navigate complex programs like tax incentives or power purchase agreements (PPAs).

- Tech Integration: Share how solar systems sync seamlessly with smart home devices or battery solutions.

Pro Tip: If you’re in solar to knock a few doors and cash a quick check, you’re thinking too small. As Carlos Villanueva said in a talk with the D2D Experts, “Play the long game. Your reputation is everything—guard it with your life.” Roberto Castaneda doesn’t sugarcoat it either: “Stop knocking four hours a day—go eight, ten, twelve. Go from zero to a thousand real quick.” This industry rewards those who go all in. Urgency, hustle, and integrity aren’t optional—they’re the price of admission if you want to build real, lasting wealth.

3. Find a Niche: Research the Needs of Your Area

Finding your niche is one of the most critical elements of starting a successful solar company. The first step in this process should be research—what are the needs of your area?

Researching the market will help ensure that you can provide solutions for people and businesses looking for these services but haven’t found them yet. To start exploring your local market, try talking to homeowners, representatives from community organizations, or other business owners about how they see their providers.

You can also look at data like average energy bills by zip code to explore where to invest. If you find an opportunity that seems good, go for it!

3. Develop a Strong Sales Pitch

Your solar sales pitch is where the magic happens. It’s not about rattling off statistics—it’s about painting a picture of how solar transforms lives. Focus on:

- Savings: Imagine saying, “With this system, you’ll save $1,200 annually.” Tangible figures resonate deeply.

- Sustainability: Tie it to the bigger picture: “Switching to solar means reducing your carbon footprint by 3 tons annually.”

- Customization: Don’t sell a product; sell a solution tailored to their unique needs, whether it’s a compact setup for a suburban home or a robust system for a warehouse.

- Incentives: Highlight local rebates and financing options. Make it sound like an opportunity they can’t afford to miss.

Pro Tip: Paint the Bigger Picture (Because This Isn’t Just About Panels)

Bring in storytelling. Share relatable anecdotes, like a family that redirected their energy savings toward a dream vacation or a business that attracted eco-conscious clients. Read the D2D Experts‘ storytelling guide to craft impactful stories.

One of the easiest ways to lose a prospect is to sell solar as a gadget or an upgrade. Solar is part of a bigger shift in how we power our lives, and the top closers sell that vision.

According to Jess Phillips, a veteran of the solar space since 2010 and a pioneer of virtual power plants, solar is riding the wave of not one but three major disruptions: solar, electric vehicles, and battery storage. As he explains in Why Solar Is The Way of the Future, we’re not just talking about saving on electric bills—we’re talking about reshaping how energy is produced, consumed, and even stored at the individual home level.

Phillips talks about how initiatives like virtual power plants already let homeowners send excess energy back to the grid—and get paid for it. That’s where solar is heading. And when you bring that level of clarity and future-forward thinking into your pitch, you’re no longer just a rep—you’re a trusted guide helping homeowners be part of something game-changing.

The key? Sell the why, not just the watts. Let homeowners feel like they’re stepping into the future—and that you’re the one who’s got the map.

Read Also “Door to Door Solar Sales Training“

5. Obtain Business Insurance

No one wants to face theft, damages, or lawsuits. You need business insurance such as general liability and workers’ compensation. If your solar installation company has employees, make sure they have worker’s compensation coverage in case someone gets injured on the job or hurt by an object dropped from above.

You’ll also need some property insurance not provided through another provider (like your landlord). This will protect against damages like fire, lightning strikes, vandalism, and other natural disasters like hail storms or hurricanes.

With adequate protection for all types of risks involved with running a small business, you and your employees can focus on the day-to-day operations of what truly matters: providing high-quality solar installations to homeowners nationwide.

6. Become an Expert in Your Niche

Ensure you have a solid grasp of the basic concepts behind solar power. A key step in becoming an expert is to learn about all there is to know about your topic. This will give you confidence and credibility when dealing with people who may not be as knowledgeable.

The solar panel industry is one of the fastest-growing industries. With more homeowners interested in renewable energy joining the industry every year, there will be increased demand for qualified installers like you!

You might have hesitated initially about getting into this industry due to the potential challenges and difficulties. But with these tips, you should have no problem starting your own business in solar panel installation!

7. Leverage Incentives and Financing Options

Cost is the most common roadblock. Your job? Turn it into an opportunity.

- Educate: Walk them through tax credits and rebates step by step. “Did you know switching to solar could cut your upfront costs by 30%?”

- Offer Financing: Simplify the numbers. Show how a PPA or loan can spread the cost into manageable monthly payments.

- Focus on ROI: Reframe the cost as an investment with long-term rewards. “Your system will pay for itself in six years, and the savings last decades.”

Pro Tip: Provide a cost-benefit analysis in writing. A clear breakdown builds trust and reduces hesitation.

Let’s get real – Most reps treat financing like an afterthought.

They crush the solar pitch and then fumble when it’s time to talk money. As Emily Wilson from BrightOaks Energy put in a D2D podcast, “Financing is a sale in and of itself.” You’ve got to be able to shift gears seamlessly – from selling solar to selling how they’ll pay for it. And that means knowing your products, understanding how term lengths, dealer fees, and interest rates work, and not projecting your wallet into the sale.

Sam – the founder and expert in chief at d2d experts calls it out perfectly: “You’re not selling panels, you’re selling a financial solution. A way to reallocate money they’re already spending and give them control.” If you don’t understand how to frame solar as a financial decision—not just a power upgrade—you’re losing deals you could’ve closed.

8. Adopt Effective Communication Strategies

Think about the last time someone truly listened to you. That’s how you want your customers to feel.

- Active Listening: When they say, “I’m worried about reliability,” don’t interrupt—acknowledge their concern before explaining the system’s durability.

- Simplify the Complex: Avoid jargon. Instead of “photovoltaic efficiency,” say, “How well the panels turn sunlight into energy.”

- Personalize Every Pitch: Tailor your approach. A homeowner might prioritize aesthetics, while a business might care about ROI.

Pro Tip: Use analogies. For example, solar panels can be compared to a “savings account,” which grows monthly as energy bills shrink.

9. Utilize Technology in Sales

The right tools can elevate your game. Here’s how to use them effectively:

- CRM Systems: Track every lead and follow-up to stay on top of your pipeline. Did you know that sales reps with robust tools are 28% more satisfied?

- Visualization Tools: Show customers exactly how their roof will look with panels and what their savings could be.

- Virtual Consultations: Make it easy for busy clients to connect with you. Incorporating virtual solar sales techniques allows you to provide convenient and informative sessions, helping clients understand the benefits of going solar from the comfort of their homes.

Pro Tip: Share a simple infographic during pitches to visually explain solar ROI. People love graphics—they’re easier to process than numbers.

10. Overcome Sales Challenges

Selling solar isn’t just about showing up with a great offer—it’s about handling resistance like a pro. Homeowners have objections, and how you respond makes the difference between closing the deal or walking away empty-handed. Whether it’s skepticism about solar savings, confusion about financing, or just a reflexive “I’m not interested,” your ability to deal with the pushback confidently is key.

Sam Taggart outlines a simple yet powerful four-step framework for handling objections effectively. Sam says most objections aren’t real concerns—just knee-jerk reactions. Your job is to control the conversation and reframe the resistance.

Sam Taggart’s 4-Step Framework for Handling Objections:

1. Ignore Minor Objections – Don’t get rattled if a prospect hits you with an immediate “I’m not interested” before they even know what you’re offering. Stay calm, stay friendly, and keep moving. For Example: Totally get it! Most of your neighbors initially felt the same way—until they saw how much they could save.”

2. Downplay Concerns – When homeowners push back, don’t fight it—reframe it. If they say, “I don’t need solar,” respond with, “For sure! Honestly, most people don’t think about it until they see how much they’re overpaying for power.” This keeps the conversation open without forcing a hard sell.

3. Act Intentionally Confused – Some objections are just automatic roadblocks. If they say, “I don’t have time for this,” instead of walking away, try: “Oh, totally! I wouldn’t want to take up your time if this isn’t valuable. Just so I understand, what’s holding you back?” This makes them explain their genuine concern, which gives you something you can address.

4. Brush It Off & Keep Moving – Instead of getting stuck on resistance, pivot back to value. If a customer dismisses you, shift the focus: “Yeah, makes sense. Real quick—has anyone shown you how much solar could cut your bill yet?” Keep it light, keep it friendly, and keep them engaged.

📌Key Takeaway from Sam’s Training: “90% of objections aren’t real—they’re just automatic responses. If you recognize that and keep control of the conversation, you’ll close more deals.”

One of the biggest challenges in solar sales—actually, in any field sales—is getting past the initial brush-off. Homeowners are bombarded by salespeople all the time, and let’s be real, most of them aren’t expecting anything different from you.

Sam walks through a live solar pitch where he overcomes resistance in real time by keeping his energy high, his tone relaxed, and his responses sharp. Instead of arguing with a skeptical homeowner, he acknowledges their hesitation and smoothly pivots to a follow-up appointment.

A homeowner pushes back with, “I already looked into solar.” Instead of treating it as a dead end, Sam leans in:

“That’s awesome! What stopped you from moving forward?”

Boom. Now, the real issue is on the table. In this case, the homeowner misunderstood financing options, and once that was cleared up, the deal closed.

Sam points out that most objections early on—“I’m busy,” “Not interested,” “We already looked into it”—are usually smoke screens, not real concerns. He teaches reps to use humor, pattern interruptions, and confidence to power through the noise.

Best Practices for Navigating Solar Sales Success in Saturated Knocking Areas

Taylor Armstrong, a top-performing solar rep who’s closed over $2 million in rooftop installations across California’s toughest neighborhoods from San Diego’s sun-soaked suburbs to Los Angeles’s high-rise enclaves, talked about 7 Best Practices for Navigating Solar Sales Success in Saturated Knocking Areas in a conversation with D2D Experts.

1. Research and Target

“In San Diego, we’re often the seventh knock on the door,” Taylor points out. To rise above the noise, mine county property data and Census tract maps to find pockets that haven’t been canvassed as heavily. These overlooked blocks often yield the best returns.

2. Know Your Customer Avatar

Taylor’s success hinges on knowing exactly who’s most likely to go solar—whether eco-conscious families in Chula Vista or tech-savvy startups in UTC. By profiling your ideal homeowner, you can tailor your messaging and demo.

3. Put in the Reps

“Think of it like lifting weights,” Taylor advises. Reps should soon hit hundreds of doors to learn which neighborhoods respond best. That sheer volume reveals patterns—time of day, street layouts, even influential community hubs—that guide smarter canvassing.

4. Adapt and Evolve

Don’t dismiss a block because it seems “overplayed.” Stay neutral, Taylor says: “What feels saturated today might hide micro-markets you haven’t uncovered yet.” Use your D2D CRM’s tagging feature to dynamically flag unexpected wins and reroute.

5. Patience Pays Off

Taylor reminds us that San Diego’s high electric rates mean big commissions—but only to those who stick it out. “Give any new area at least three months before writing it off,” he says. Persistence often comes with high-value deals in places other reps abandon.

6. Balancing Act

Don’t become a one-trick pony once you’ve identified your hot zones. Rotate into nearby, less-knocked ZIP codes so leads stay fresh, and competitors are left guessing.

7. Strategies for Less Saturated Areas

With your ideal-customer profile and on-the-ground insights, branch into adjacent neighborhoods with lower solar awareness. Host a local block party or partner with community groups—a proactive intro can open more doors than a cold knock.

Pro Tip: Log every detail in your field sales CRM—use custom fields for “Knock Count” and “Response Outcome.” A weekly report will highlight which strategies deliver the highest ROI.

Where to Sell Solar Products and Services?

a. Sales Channels

Online Platforms: E-commerce sites and social media campaigns are powerful tools for reaching a broad audience. Platforms like Facebook Marketplace, Instagram, and specialized solar marketplaces allow you to showcase your offerings to homeowners and businesses. Combine these with targeted advertising to attract high-quality leads and drive traffic to your website or online store.

Local Dealerships and Partnerships: Collaborating with local contractors, electricians, and home improvement stores can expand your reach. These partnerships allow you to tap into established customer bases and position your products as part of a comprehensive service package. For example, partnering with a contractor specializing in energy-efficient home upgrades can lead to bundled service offerings, increasing your value proposition.

Solar Expos and Trade Shows: These events provide access to potential customers and industry professionals. Use trade shows to demonstrate your products, showcase customer success stories, and build credibility. Consider offering live demos or special discounts for attendees to encourage immediate action.

Door-to-Door Sales: Focus on neighborhoods with high solar potential and come prepared with data-driven insights to address common objections. Solar sales training can help you develop the skills needed to provide personalized energy assessments and create tailored proposals that make your pitch more compelling.

b. Target Locations

Areas with High Energy Costs and Sunlight Exposure: Regions with high electricity rates and abundant sunlight offer the most significant opportunities for solar adoption. Use local data to highlight how your products can drastically reduce energy costs. Tailored marketing campaigns in these areas can amplify your message and maximize lead generation.

Newly Built Residential Communities: Targeting new developments allows you to reach homeowners looking for long-term energy solutions. Promote solar as a modern and sustainable feature that enhances property value. Collaborating with builders to include solar installations in new construction projects can open doors to larger-scale opportunities.

Industrial Zones Seeking Sustainable Energy Solutions: Businesses in industrial zones are often motivated to reduce operational costs and meet sustainability goals. Highlight the ROI of solar energy systems for commercial use, including tax incentives and environmental benefits. Offering customized solutions for warehouses, factories, or office buildings can set you apart in this sector.

Importance of Marketing Solar Products

Marketing is the backbone of any successful solar business. Did you know that 90% of buyers say marketing content helps them make more informed decisions? It doesn’t just generate leads; it creates awareness, builds trust, and establishes your brand as an authority in the solar industry. Here’s why it matters:

a. Educating Customers and Building Awareness

Educating Customers: Use content like blogs, videos, and infographics to demystify complex concepts and make solar energy accessible. For instance, a video showing the installation process can help address fears about disruptions, while a detailed blog can highlight how solar energy directly reduces energy costs.

Building Awareness: Marketing campaigns focused on raising awareness create informed buyers. Highlighting real-world examples like local solar success stories can connect with prospects on a personal level. Use email campaigns to provide bite-sized information about tax rebates, potential savings, and environmental impact. Interactive tools like calculators for solar ROI can empower customers to visualize their savings and take the first step toward installation.

b. Reaching a Wider Audience

Targeting Key Segments: Use tools like SEO, social media, and email campaigns to connect with different audience segments. For instance, homeowners might respond to personalized ads showing potential savings, while businesses might be more interested in environmental benefits and energy cost reductions. Tailoring your message ensures higher engagement rates and better lead conversion.

Expanding Reach: Social media platforms like Instagram and Facebook allow localized targeting. Combine this with pay-per-click (PPC) campaigns to ensure you’re reaching high-potential customers. Use geo-targeted ads to focus on neighborhoods or businesses where solar adoption is likely to have the most significant impact.

c. Building Credibility

Showcasing Success: Credibility is crucial when selling a product like solar energy, which requires significant investment. Share real customer testimonials that describe their experience and results. Highlight certifications and awards that prove your company’s expertise and reliability. Creating a portfolio of case studies with measurable outcomes can solidify trust and encourage prospects to take the next step.

Providing Proof: Prospective clients need proof that solar energy delivers on its promises. Include before-and-after data from previous projects, such as energy cost reductions or environmental savings. Offering live examples, like an open house with a recent installation, can provide tangible proof and make the decision process easier for skeptical customers.

d. Driving Lead Generation

Marketing plays a huge role in driving lead generation by effectively capturing and nurturing potential customers. Here are key ways marketing can fuel your lead pipeline:

Create Valuable Content: Blogs, videos, and infographics that address common questions about solar energy can attract and educate prospects. For example, a blog titled “Top 5 Reasons to Switch to Solar” could rank in searches and pull in leads organically. High-quality content positions your brand as an authority and creates a sense of trust before customers even engage with you.

Implement Targeted Campaigns: Use data-driven advertising strategies on platforms like Google Ads and Facebook. Segment audiences based on demographics, behaviors, and interests—such as homeowners in sunny regions or businesses seeking sustainability solutions. Tailored campaigns ensure you’re reaching the right people at the right time.

Leverage Lead Magnets: Offer free consultations, downloadable guides, or solar savings calculators in exchange for contact information. These resources not only provide value but also identify interested customers who are ready to engage further.

Nurture Leads with Automation: Email marketing and CRM systems can automate follow-ups, keeping prospects engaged throughout their decision-making process. For instance, a follow-up email series could include educational content, testimonials, and reminders about time-sensitive offers.

Tips for Closing a Solar Sale

a. Build a Sense of Urgency

Highlight Time-Sensitive Offers

Informing customers about limited-time rebates or rising energy costs is one of the most effective ways to create urgency. Explain how rebates or tax credits, such as federal or state solar incentives, are only available for a specific period. Use real numbers: “This rebate could save you up to $5,000, but it expires at the end of the quarter.” Additionally, discuss trends in energy costs—”Electricity rates have risen by 5% annually, and switching to solar now can lock in your savings for the next 25 years.” Presenting these facts shows customers the financial benefits of acting quickly.

Stress Immediate Benefits

Solar installation provides immediate benefits, such as reduced energy bills starting the first month. Explain to homeowners how delays mean continued reliance on volatile energy markets, leading to higher long-term costs. For businesses, highlight how solar can align with sustainability goals and quickly improve their eco-friendly brand image. Combine these arguments with specific projections: “By switching to solar this month, you could save $1,200 annually, and those savings begin immediately.”

b. Build Trust and Confidence in the Decision

Use Detailed Savings Estimates

Provide potential clients with transparent, customized savings reports. These reports should outline upfront costs, available incentives, and long-term savings projections. Include graphs and charts showing cost comparisons between staying on the grid versus installing solar. For example, “Over 20 years, this system could save you $30,000 in energy costs.” Transparency in these estimates reassures clients that the investment is sound and reliable.

Share Relatable Success Stories

Nothing builds trust better than hearing about others’ positive experiences. Share testimonials or case studies from customers in similar situations. For instance, describe how a local family reduced their energy bills by 70% or how a small business saved thousands annually while achieving its sustainability goals. Include before-and-after statistics to give credibility to these stories. Visual aids such as photos or short video testimonials amplify the impact.

c. Address Final Concerns

Be Ready for Questions

Addressing common questions proactively is key to overcoming last-minute hesitations. Create a list of frequently asked questions, such as:

- “What happens during maintenance?”

- “What warranties are included?”

- “How does solar affect my home’s resale value?”

Respond confidently and ensure your answers are detailed yet simple enough to understand. For example, explain warranties with clear terms: “Our panels come with a 25-year performance warranty, ensuring they’ll operate at 85% efficiency or better throughout that period.”

d. Follow Up

Send Personalized Thank-You Notes

Send a personalized thank-you note after each interaction, whether a consultation or installation. A simple message like, “Thank you for allowing us to discuss how solar can benefit your home. Let us know if you have any questions,” shows genuine appreciation. Consider sending a small gift, such as a solar-powered gadget, for larger installations to create a lasting positive impression.

Encourage Referrals

Satisfied customers are your strongest advocates. Encourage referrals by offering incentives, such as discounts on future maintenance services or cash rewards. For example, “Refer a friend, and you’ll receive $200 off your next service.” Create a seamless referral process through digital forms or QR codes to make it easy for clients to participate.

Common Questions in Solar Sales

1. How hard is it to sell solar panels?

Selling solar panels can be challenging, but success lies in understanding customer needs, addressing objections effectively, and providing clear benefits. For instance, if a customer hesitates due to cost concerns, demonstrate how tax incentives and long-term savings outweigh the initial investment.

2. How to sell a house with leased solar panels?

Explain the lease’s savings and benefits to potential buyers. Show them how the lease transfers seamlessly and highlight the reduced energy costs they’ll enjoy. A detailed breakdown of the lease terms and benefits reassures buyers that they inherit a value-added feature.

3. How to sell solar panels door-to-door?

Focus on high-potential neighborhoods, such as those with rising energy costs or new developments. Build rapport quickly by engaging homeowners with personalized energy assessments. Address objections confidently, such as by explaining why solar is effective even in less sunny regions.

4. How to sell solar panels fast?

Leverage limited-time offers to create urgency. For example, highlight rebates that expire soon or emphasize rising energy rates. Pair these with immediate benefits, such as locking in lower energy costs from day one.

5. How to sell solar panels over the phone?

Keep calls concise and data-driven. Use clear visuals and online tools to explain savings and installation processes. A digital presentation sent during the call can help customers visualize the benefits and maintain engagement.

Final Thoughts: What to do Next?

Join Door-to-Door Sales Communities: Connecting with others in the industry can provide invaluable insights and motivation. Engaging with these communities keeps you updated on the latest trends and techniques in solar sales.

Polish Your Skills with Door-to-Door Sales Resources and Books: Invest time in personal development by exploring door to door resources and top books on sales strategies, negotiation techniques, and overcoming objections.

Explore Courses in Solar Technology and Sales: Continuous learning is crucial in a rapidly evolving industry like solar. Enroll in online courses that cover technical aspects of solar energy systems, government incentives, and advanced selling techniques. Platforms like Coursera, Udemy, and industry-specific training programs can help you stay ahead of the competition.