The FLSA outside sales exemption is one of the most misunderstood and risky areas of labor law for sales-driven companies. Are your highly-paid, commission-only field reps actually exempt from overtime? If your classification is wrong, you aren’t just facing a wage dispute—you are exposed to crippling financial and legal risk. Misclassification leads to class-action lawsuits, severe penalties, and mandated back pay dating back years.

This article will break down the precise rules governing the exemption, highlight the common compliance pitfalls that trip up employers, and provide immediate, actionable steps to audit your team and protect your business.

Attention – Why employers struggle with outside sales exemption

Compliance with the Fair Labor Standards Act (FLSA) is not optional, and the cost of guessing the rules is catastrophic.

“The greatest danger in times of turbulence is not the turbulence; it is to act with yesterday’s logic.” – Peter Drucker.

In the age of hybrid work and digital selling, yesterday’s logic—assuming any highly compensated sales rep is exempt—is a massive liability. If ignored, the consequences can include mandatory back wages, liquidated damages (doubling the back pay), and civil money penalties from the Department of Labor (DOL).

Key Takeaways

- The exemption depends entirely on the primary duty test, not how much the employee earns.

- Misclassification is a high-risk liability leading to back pay and double damages.

- Remote and hybrid roles pose the greatest challenge for exemption compliance today.

- You must audit job descriptions and sales activity logs to prove the exemption.

Interest – Understanding the FLSA outside sales exemption rules

The FLSA defines minimum wage, overtime pay, recordkeeping, and child labor standards for most private and public employment. The outside sales exemption is an exception, allowing employers to avoid paying overtime (time and a half) for hours worked over 40 in a workweek, provided the employee meets a strict set of tests.

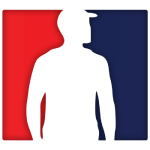

What qualifies as outside sales under FLSA

The exemption is explicitly defined by the DOL Fact Sheet #17F:

- The employee’s primary duty must be making sales or obtaining orders for services.

- The employee must be regularly and customarily engaged in this work away from the employer’s place or places of business.

The primary duty test

The “primary duty” is the principal, main, or most important duty the employee performs. For the outside sales exemption, this means:

- The employee must perform the duties of selling (or obtaining orders) as the primary duty.

- The amount of time spent on selling activities must be regular and customary.

Unlike other executive or administrative exemptions, there is no minimum salary or fee level required for the outside sales exemption. An employee paid commission-only can be exempt if they meet the exemption test.

Common compliance pitfalls

Employers commonly stumble when classifying these roles:

- Remote/Hybrid Roles: Classifying a remote rep whose sales are primarily conducted via phone/internet from their home office as exempt. The rule requires the work to be regularly and customarily performed away from the employer’s place of business, not just away from the main corporate office.

- Inside Sales Misclassification: Assuming a telemarketing or inside sales role—where sales are made from an office location—qualifies.

- Incidental Duties: Employees whose primary duty is delivery, not sales (e.g., milk truck driver who occasionally sells), do not qualify.

Desire – Why compliance matters for your business

Financial and legal risks of misclassification

If an employer misclassifies outside sales employees, they face severe consequences:

- Back Pay Liability: Paying the employee for all past overtime hours.

- Liquidated Damages: Often required to pay an additional amount equal to the back pay (doubling the penalty).

- Civil Money Penalties: Fines from the DOL.

The DOL recovers millions in back wages annually due to FLSA violations.

Real world scenarios

- Small Business Misclassification: A small roofing company classified its canvassers (who only generated leads and did not close sales) as exempt outside sales reps. A DOL investigation found the primary duty was not closing sales, leading to significant back pay for all non-exempt hours worked.

- Large Pharma Case: A major pharmaceutical company faced a class-action lawsuit where thousands of sales reps successfully argued that their administrative tasks and meeting preparation—performed from home—negated the “primary duty” test, resulting in multi-million dollar settlements.

Comparison Table: Outside vs. Inside Sales (FLSA)

| Feature | Exempt Outside Sales (FLSA) | Non-Exempt Inside Sales (FLSA) |

| Primary Duty | Making sales or obtaining orders | Making sales or obtaining orders |

| Work Location | Regularly & customarily away from the employer’s business | Primarily performed at or from the employer’s place of business |

| Overtime Pay | Not required (Exempt) | Required (Non-Exempt) |

| Salary Requirement | None required | None required |

Fewer “try again tomorrow” days

Quick bites, real scripts, instant answers (for free)

Action – Steps employers should take now

Things to consider

- Internal Audits: Conduct a self-audit of all existing sales job descriptions and compare the stated duties with actual, logged employee activities.

- Job Descriptions: Ensure descriptions clearly define the primary duty as making sales away from the office.

- HR Training: Mandate training for all HR personnel and sales managers on the difference between inside and outside sales roles.

Bonus point

The complexity of the FLSA rules means your best defense is proactive action. Immediately consult with specialized HR software or legal counsel to review your classifications.

Note

The growth of hybrid and remote sales teams necessitates extremely careful handling of the exemption. If a rep’s primary duty is performed via phone or computer from their home, they likely fail the “away from the employer’s business” test.

Disclaimer

This content is for informational purposes only and does not constitute legal advice.

FAQs – FLSA outside sales exemption explained

What is the FLSA outside sales exemption?

It is an exception under the Fair Labor Standards Act that allows employers to classify employees who meet specific duties and location tests as exempt from minimum wage and overtime pay requirements.

Do outside sales employees need to be paid on a salary basis?

No. Unlike most other FLSA exemptions, the outside sales exemption does not require that the employee be paid on a salary basis.

Are commission-only outside sales reps exempt from overtime?

Yes. If a commission-only outside sales employee meets the primary duty test and the location test (regularly working away from the office), they are exempt from overtime.

Can remote workers qualify under the outside sales exemption?

Only if their sales work is primarily performed away from any fixed office, including their home office, through activities like visiting customers or generating sales leads in person.

How does outside sales differ from inside sales under FLSA?

Outside sales requires the primary duty of selling to be performed away from the employer’s place of business, whereas inside sales involves selling primarily from the office via phone or internet.

What documentation should employers keep to prove exemption?

Employers should keep detailed job descriptions that specify “primary duty” and sales activity logs that verify the employee is regularly working away from the office.

What happens if an employer misclassifies outside sales employees?

The employer is subject to lawsuits, payment of all accrued overtime (back pay), and often liquidated damages (doubling the back pay penalty).